Financial and Accounting Services are one of the core elements of a business organization. Thus, it is the responsibility of accounting firms and staff to perform their duty with utmost care and dedication. After understanding the weight of accounting work, some of the CPA firms in the US are adopting alternative hiring models to develop flawless accounts like offshore staffing for accounting firms.

But, what’s offshore staff, and how it is different from outsourcing?

What Is Offshore Staffing?

First and foremost, you need to clarify that offshore staffing and outsourcing are two completely different hiring models. Offshoring stands for the relocation of business operations from one country to another in search of better growth and productivity. On the contrary, outsourcing merely means contracting a particular job to an external company located globally.

In the context of accounting, remote staffing for accounting firms refers to professional accounting companies like CapActix that provide technical solutions to small, medium, and large corporate accounting firms. Accounting companies can delegate selected parts of their work to offshore teams or they can delegate the work of an entire department.

Most US accounting firms are looking forward to offshore staffing solutions because, in spite of being highly important work, accounting is still not a core operation for various businesses. For example, for a company dealing in the manufacturing of socks, for this company accounting won’t be a core work, but still, somehow important. So, these businesses go ahead and appoint accounting firms to handle their work which eventually increases the workload of accounting firms, and then they seek solutions in the form of offshoring staffing.

Is there a shortage of accountants in the USA?

The United States Bureau of Labor Statistics (BLS) estimates that 136,400 accountant and auditor vacancies will be created each year over the next decade. This could lead to a competitive job market for top talent, and the longer the shortage persists, the more significant its impact will be.

The shortage of accountants could lead to a decline in accountability and integrity in businesses. This could mean an increase in fraud and compliance issues. Even small accounting errors can cause a company’s stock price to drop, which can lead to further financial problems.

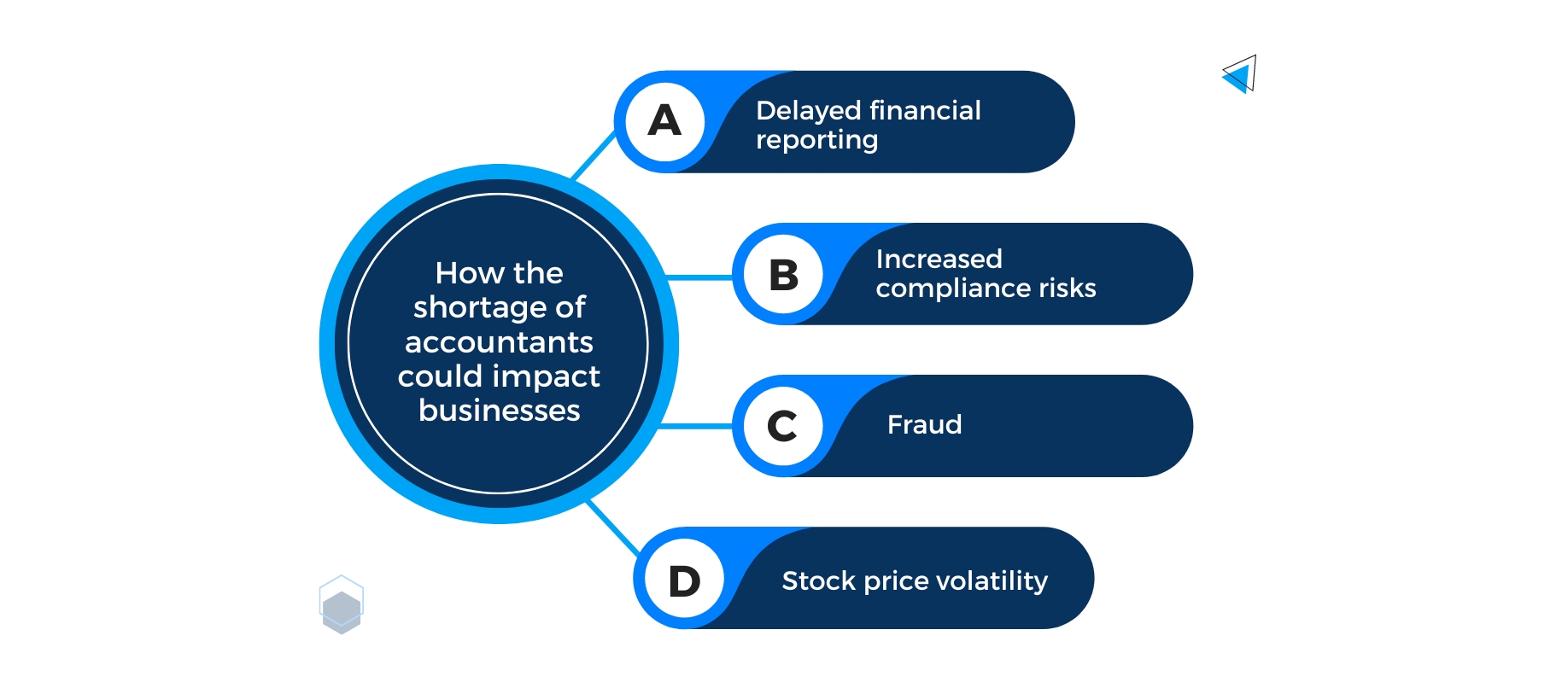

Here are some specific examples of how the shortage of accountants could impact businesses:

- Delayed financial reporting: Businesses may have difficulty finding qualified accountants to prepare their financial statements, which could lead to delays in reporting. This could make it difficult for businesses to obtain loans or make strategic decisions

- Increased compliance risks: Businesses may not be able to comply with all applicable regulations if they do not have enough qualified accountants. This could lead to fines or other penalties

- Fraud: The shortage of accountants could make it easier for businesses to commit fraud. This is because there may be fewer people to detect and investigate fraudulent activity.

- Stock price volatility: Even small accounting errors can cause a company’s stock price to drop. This is because investors are concerned about the accuracy of a company’s financial statements. If there are too many accounting errors, investors may lose confidence in the company and sell their shares, which could cause the stock price to drop further.

The shortage of accountants is a serious problem that could have a significant impact on businesses. Businesses need to take steps to address the shortage, such as offering competitive salaries and benefits to attract qualified accountants. They should also invest in training and development programs to help their current employees develop the skills they need to be successful in accounting.

Must Read Build Your Own Tax Team with Offshore Staffing Solutions

Is offshore staffing the solution to the shortage of accountants in the USA?

Offshore staffing can be a solution to the shortage of accountants in the USA, but it is not the only solution. There are a number of other factors that businesses need to consider when deciding whether or not to outsource their accounting needs.

What Are The Benefits Of Offshore Staffing For Accounting Firms In The US?

The accounting industry is highly competitive; thus, it is very crucial for new CPA firms to maximize their profits as soon as possible. Profit is one of the major parameters to define growth and expansion for accounting firms. Here, the offshoring staff is turning out to be one of those effective solutions with which accounting companies can go on the path of profit.

However, cost efficiency is a very narrow-down benefit of remote staffing for accounting firms as there are multiple other unveiled benefits present beneath the hiring model for offshore staffing companies in the US. For instance –

1. You won’t lose a potential client

The best thing about offshore staffing is that you have a dedicated, qualified, and expert offshore team at your beck and call. Therefore, your ability to handle bookkeeping and accounting work increases tenfolds. Additionally, if you hire offshore accounting services from different time zones like India and the US where they have 12 hours of time difference between them, you will be able to provide around-the-clock services.

So, if you receive an urgent call from your client, then you can instantly take up their work as you have a backup team to support you. This will eventually increase the profit and reputation of a new accounting company among the clients.

2. Reduce fear of losing employees

If you are in the accounting business for a long time, then you must know how hard it is to find a competent employee and how difficult it is to retain good employees in this competitive industry. Companies have to sometimes bear a huge loss if their accountant quits. This blow will be even harder for small and medium-scale companies as they have to hire new accountants urgently by paying extra money.

But, if you have an offshore accounting team, then you don’t have to lose your work even if your in-house staff quits without giving prior notice. That’s because offshore accounting companies have support from various accounting professionals to tax experts. You just need to contact them for certain services and they will instantly provide that to you.

3. High-end quality check

Accounting is a very delicate job – a single wrong entry or miscalculation can cause you great trouble. Business organizations trust the services of professional accounting firms only because they are frustrated with the number of errors and reviews needed in their in-house accountants’ work. But, when professional accounting firms dump lots of work on their in-house staff, then they are not able to pay the required attention to work and this gradually increases the level of errors.

But it’s good luck that offshore staffing for accounting firms can eliminate this problem as you can be more stringent with your service provider and demand quality and efficient work which was mutually agreed upon. With this service, accounting firms can even enhance their operational productivity and business profit.

4. Offer something extra to your clients

If you always want to grow your accounting business and want to offer some additional services to your clients like auditing, tax preparation, payroll, etc., Then, you might have to face hurdles in the form of lack of time, limited budget, unavailability of experts, and a number of other factors.

But you can know to provide extra services to your clients by offspring. Such as if you want to provide tax preparation services to your clients during tax season, then you can offshore service for a limited time only and provide complete financial solutions to your clients under one roof.

5. Hire offshore staff suiting your business cycle

Normally, businesses have accounting and bookkeeping workloads for a specific duration as per their business cycles that eventually depend on their business structure. For instance, banking and finance organizations have a heavy accounting workload at the end of the financial year as they have to close all accounts.

So, offshore accounting services for such businesses allow accounting firms the opportunity to easily handle the extra workload on a particular period without increasing the staff. This will offer flexibility to the accounting firms but are pretty hard to achieve.

Must Read CPA Worries Clients’ Data Disclosure In Offshoring Tax Services: Should They Worry?

6. High profitability without extra efforts

The prime idea behind offshore staffing for accounting firms is to make more money by reducing back some expenses without disturbing the workflow and putting in more effort. In this hiring model, foremost you reduce some expenses by cutting down overheads like part-time wages and other departmental overheads. This offers the opportunity to accounting business owners to utilize their free time in creating marketing ideas to promote their business. By offshoring work accounting firms can increase their business profit in multiple different manners.

Points to Consider While Choosing an Offshore Staffing For Accounting Firm

When choosing offshore staffing, accounting firms should consider several key factors to ensure that they are selecting the right offshore partner for their needs. Here are some points to consider:

- Cost.

Offshore staffing can be a cost-effective way to access specialized skills and resources. However, it’s important to compare the cost of offshore staffing to the cost of hiring in-house staff. You should also factor in the cost of training, communication, and management. - Quality of service.

The quality of the service provided by an offshore staffing provider is essential. You should make sure that the provider has a good track record of providing high-quality work. You should also check the provider’s references and ask for samples of their work. - Flexibility.

You need to make sure that the offshore staffing provider is flexible enough to meet your needs. You should be able to scale up or down your workforce as needed. You should also be able to change the type of work that you outsource as your needs change. - Reliability.

The offshore staffing provider should be reliable and responsive. You should be able to reach them when you need to, and they should be able to deliver on their promises. - Security.

The offshore staffing provider should have strong security measures in place to protect your data. You should make sure that the provider has a secure infrastructure and that they follow best practices for data security. - Time zone difference.

If you are located in a different time zone than the offshore staffing provider, you need to make sure that the time difference will not be a problem. You should be able to communicate with the provider during your working hours, and they should be able to deliver on their promises on time. - Language barrier.

If you are not fluent in the language of the offshore staffing provider, you need to make sure that there is a way to communicate effectively. You should be able to communicate with the provider in your own language, or you should have access to a translator. - Cultural differences.

There may be cultural differences between you and the offshore staffing provider. You need to make sure that these differences do not create any problems. You should be aware of the cultural norms of the provider’s country, and you should be respectful of these norms. - Legal implications.

You need to make sure that there are no legal implications to outsourcing your work to an offshore staffing provider. You should check with your lawyer to make sure that you are in compliance with all applicable laws.

By considering these points, businesses can select an offshore staffing provider that meets their specific needs and helps them achieve their goals.

How much can you save with offshore staffing

The exact amount of savings that can be achieved with offshore staffing will vary depending on several factors, such as the size and type of business, the specific roles being outsourced, the location of the offshore staff, and the level of experience and skill required for the job. However, it is estimated that businesses can save up to 70% on labor costs by outsourcing jobs to countries with lower labor costs.

In general, offshore staffing can provide cost savings in several areas, including labor costs, taxes, benefits, and overhead expenses. For example, businesses can hire skilled workers in countries with lower labor costs and pay them lower salaries than they would for equivalent positions in their home country. Additionally, offshore staff may not require the same level of benefits or insurance coverage as domestic staff, further reducing costs.

Must Read How Outsourced Tax Preparation Services save over 70% of CPA Firm’s Cost?

Conclusion

Offshore staffing for accounting firms can open up the box of benefits by which they can increase their profit, flexibility, and productivity without putting in the extra effort. There are plenty of other noncore benefits that can even further be generated by accounting firms in the US by trusting the expertise of offshore staff.

Now, whether you want to hire offshore staff to handle the work of your entire accounting department or one particular job, you can contact CapActix and get a deep briefing from our managers. You can contact us at email – biz@capactix.com. or can calling on +201-778-0509.