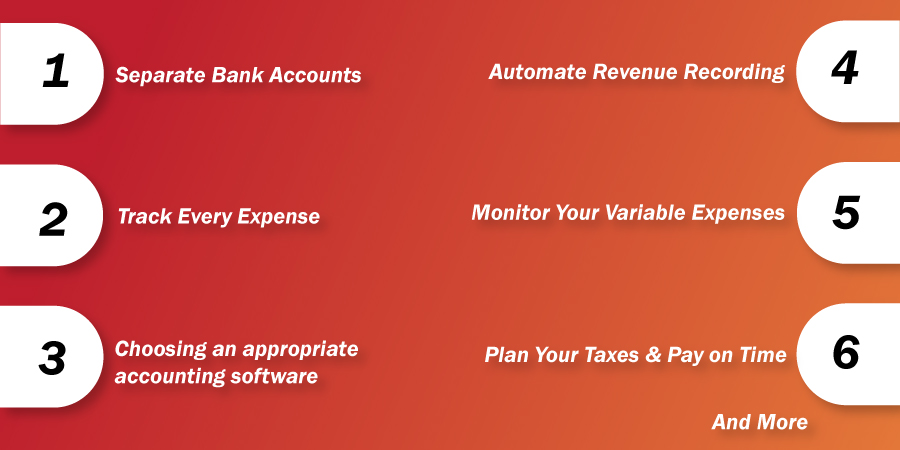

Small businesses have a bunch of issues to look after. It is extremely important to set the priorities straight out for smooth business operations. There are several aspects you need to pay extra attention to when your business is in a nascent stage. Accounting is one of those key aspects to take into consideration while growing your business. Accounting for small business requires extra attention as in case of any mistake, the small-scale firms have to bear heavy losses. We have listed down some of the best accounting practices for small business owners to follow.

Separate bank accounts

Opening up a bank account exclusively for your small business is the first step, to begin with. It is essential in small business accounting as it helps you most when you tally your expenses and incomes. It is also useful when you issue a new credit card for your business. It is basically to keep a track of your billing payment and expenditure.

If it is a partnership or LLC, then it is a compulsion. But even for single-owner businesses, we recommend this.

Track every expense

Every penny counts! For any business to be successful, you need to watch your expenses closely and analyze them as well. From cash flow to financial statements, everything has to be scrutinized thoroughly. It is a great habit for small business accounting that will help you in the long run leading to profitability.

Choosing an appropriate accounting software

Technology is now an inseparable part of any business today. It’s no longer an option in this digital world. It is good to be equipped with the latest software and tools of your business. Look out for the right features that simplify the accounting processes. There are several cloud-based accounting softwares in the market today. You can access them anywhere and they provide you with business analysis reports with valuable insights.

We at CapActix, have expert software accounting consultants who know the right set of tools for your business. They will walk you through the entire process of seamless integration of software with business operations.

Automate revenue recording system and monitor your receivables

It often becomes hectic to track down revenue from sales, loans and other finances. As mentioned earlier, with the help of the right software, automate the revenue lifecycle. It will bring in more accuracy and eliminate the manual labour from the process. Verify invoices with actual payments received. Otherwise, you will end paying extra taxes what nobody wants to do!

Monitor your variable expenses and fixed overhead

It is essential to examine every single dollar going out of your pocket, be it variable and fixed overhead cost. It is basically your business budget. To maintain accuracy in the accounting process, you should be aware of your capital expenditure. This will help better plan and save your finances.

Plan your taxes and pay on time

You don’t want to get penalized. Do you? So, we advise you to hire a tax preparer. It will not just help you plan tax payments better but save your money as well. It will also ensure that you file your tax returns timely. Initially, you may not be able to pay taxes in full. Taxes sometimes can be tricky to understand and calculate and small businesses have to suffer. A seasoned accountant will make it easy for you. He will facilitate you with a payment plan to pay your taxes in installment over a certain period of time.

Reconcile your banks, vendors and customers’ account regularly

Your business needs sound accounting skills to manage cash flow and control accounts. Accounts reconciliation helps you rectify issues and verify transactions to balance your business accounts. CapActix’s control accounts reconciliation services help you bring transparency and detect any unusual transactions.

Maintain proper record of inventory

Establish proper inventory controls. Monitor the usage of goods and perform the timely audit of inventory. Make sure everything is in order and not misplaced. Allow the entry to the limited personals. Having an inventory management software helps control your stock more efficiently. We at CapActix, offer custom inventory management services to manage your stocks. It brings you to achieve more accuracy and efficiency in business operations.

Establish a sound internal control system

There are chances of frauds and misuse of funds in any business. A strong internal control system is utmost important to minimize risks. Our risk management and internal control consulting services enable you to establish a sound internal control process to achieve your business goals.

Hire a professional accounting firm

Outsourced services of accounting for small business are inevitable. Nobody can replace an experienced accountant to work out with your finances. As you are going to occupy with your core work, it is better to leave it up to experts. From making tax plans to achieving accuracy in financial data, a professional outsourced accounting firm can help you build a robust financial management system for your business growth.

Winding up/Final thoughts/Conclusion:

It is imperative to put good accounting practices in place to ensure smooth functioning of your small business. Be aware of risks and other critical factors regarding your accounts and eliminate them. We suggest if you don’t have time or skills, take help of an accountant to deal with it.

If you have trouble handling your accounts or keeping your books, get in touch with us at biz@capactix.com. or simply call us on +1 201-778-0509.