The accounting industry is evolving in dynamic ways that no one could have ever imagined a few years ago. Today, multiple different types of accounting software are available in the market to overcome shortcomings of traditional accounting such as tax preparation, bookkeeping, payroll, AR & AP, and more.

For small businesses, accounting software is the best way to gain a competitive edge against large business organizations. Traditionally, small businesses have to rely upon local accountants to manage their accounts, which offers them limited solutions only.

With the advanced accounting software, small businesses can use accounting outsourcing services that can open up numerous new opportunities ahead of them. On the top, accounting and finance technologies are rapidly growing and empowering small businesses with propelling efficiency.

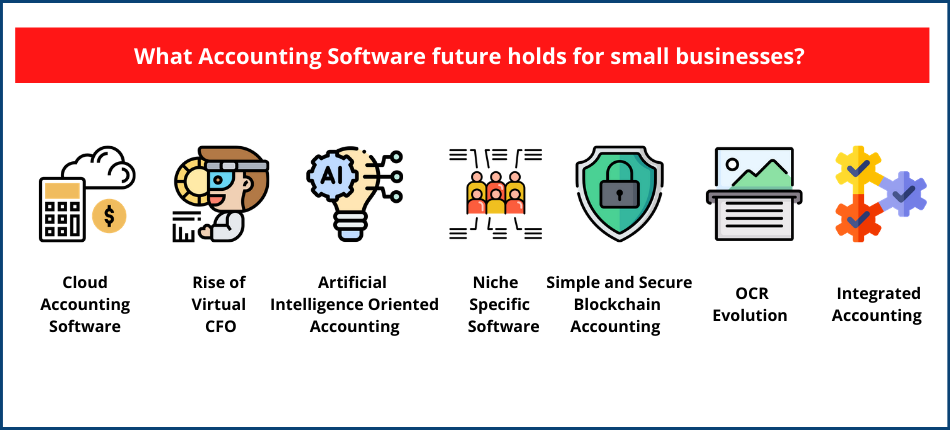

What Accounting Software future holds for small businesses?

According to Fortune Business Insights, the global accounting software market is expected to grow at a CAGR of 8.02%. The accounting software is integrated with numerous progressive technologies to provide better results, such as big data, artificial intelligence, optical character recognition, and more.

From accounting outsourcing services to high-tech software, the future of accounting software for small businesses holds many prosperous changes, including:

Cloud Accounting Software

The need for better security and real-updates have dramatically increased the demand for cloud accounting software. With cloud-based accounting software, small businesses can receive accounting services anytime, anywhere, and on any device.

The global cloud accounting software market is projected to reach $4.25 billion by 2023. The cloud-based software makes it easier to collaborate and access all financial information from anywhere. With cloud technology, transparency and accountability can be easily achieved in accounting services.

Our accounting outsourcing company has been providing fast and effective accounting services to global users due to cloud technology. We only use cloud-based accounting software so that we can offer real-time solutions to our clients.

Rise of Virtual CFO

The future of accounting software is anticipated to rise the role of virtual CFO. The virtual CFO provides logical accounting services based on accurate and relevant reports. They narrate the story behind numbers and assist small businesses in making the right decisions. Your virtual CFO will understand your business, the people present in the business, and their needs, and then they process the entire information together.

At CapActix, we use the latest accounting software to provide the best virtual CFO services to businesses. We help our clients to make the right decisions based on accurate data after critically analyzing their business objectives.

Artificial Intelligence Oriented Accounting

Artificial intelligence will never take an accountant’s place, but AI-based software can reduce redundancy in accounting operations. Around 80% of business executives already believe that AI can provide them a competitive edge.

For small businesses, it is very important to save their time and money by trying different methods. When repetitive entries are automatically managed by artificial intelligence-based accounting software, small businesses can save time, which they can use elsewhere.

Niche-Specific Software

In the last few years, accounting software has grown a lot. Today, we have multiple different types of accounting software available in the market. Based on the functionality and usability, you can find an array of accounting tools, such as:

- Xero is a cloud-based accounting tool

- Drake is a tax software

- ADP is payroll software, etc.

With the niche-specific accounting software, small businesses gain more accuracy and efficiency in their accounting operations. They can easily improve their financial system and step up with the large business organizations.

Simple and Secure Blockchain Accounting

The paperless economy isn’t too far in the future. Due to dynamic technologies like Blockchain, cryptocurrencies are becoming part of the mainstream economic system. Today, cryptocurrencies might not be fully legal, but businesses are investing a lot in this new digital currency.

If small businesses start to use Blockchain accounting, they can automate auditing services and reduce frauds to nil. However, this change won’t be seen for very long as cryptocurrencies aren’t legal monetary tender in many countries. But, in the future, we will definitely see more of Blockchain accounting.

OCR Evolution

Today, when the accounting industry is focused on new technologies like AI and Blockchain, it seems surreal to talk about the technology developed in 1914. But, in the future, Optical Character Recognition (OCR) technology will evolve more and helps businesses reduce countless hours of processing time. The OCP can translate characters into telegraph codes by using machines to read handwritten characters and convert them to electronic data.

Nowadays, businesses can click a photo of receipts using their smartphones and upload it on the mobile accounting software to automatically create expense accounts. For small businesses, this practice will reduce data entry time and manual recording errors.

Integrated Accounting

The future of accounting software demands powerful and robust integration. With the changing nature of businesses, it is crucial to have accounting software that can easily coordinate with other software and tools.

For instance, if you are running a small eCommerce business, you need accounting software that can integrate with your CRM (Customer Relationship Software), payroll time tracking, invoicing, logistics management, and other software.

Therefore, in the future, accounting software for small businesses will be more integrated and flexible. Software like QuickBooks has already step towards integration with 600+ business apps such as PayPal, Google Calendar, etc.

Here you can read about the Top 5 Payroll Accounting Software of 2021 – 5 Tips to Pick the Right Software for Dynamic Payroll Processing Services

Wrap Up

The future of accounting software for small businesses is very bright—from various progressive technologies to innovative solutions. In the upcoming years, accounting software is going to help small businesses to a great extent. The software can improve the financial health of small businesses in multiple ways.

However, it is a shame that only 64.4% of small and medium-sized businesses in the United States use software to streamline their accounting operations. If you also haven’t adopted accounting software to manage your accounts, you can use the best accounting outsourcing company‘s services today!

At CapActix, we use all the latest accounting technologies to improve your accounting activities’ functionality and efficiency. So, give us a call anytime.