In today’s fast-paced and competitive business world, companies are constantly looking for innovative ways to streamline their financial processes. Remote accounting services offer a transformative solution, enabling businesses to enhance their financial efficiency and maximize profitability. By harnessing the power of remote accounting, organizations can simplify their financial management, unlock greater agility, and drive growth. More than 37 percent of small businesses are outsourcing accounting services.

How Remote Accounting Services Can Streamline Your Financial Processes?

Traditional accounting practices generally include manual data entry, exhaustive paperwork, and tedious tasks. Remote accounting services have emerged as a great alternative for organizations looking to streamline their financial processes.

Here is how outsourced accounting services can streamline your financial processes.

a. Real-time access to financial data

Leveraging cloud-based accounting software, remote accounting services provide instant access to financial records. This empowers businesses to make timely decisions based on up-to-date data and accurate reports.

b. Greater efficiency

With accounting outsourcing services, businesses can access accounting expertise and services from anywhere in the world. Remote accountants can efficiently handle tasks such as bookkeeping, payroll processing, invoicing, and financial reporting without any geographical constraints. This flexibility allows businesses to save valuable time, reduce costs, and focus on core activities that drive growth.

c. Improved accuracy and reliability

Remote accountants, equipped with advanced accounting software, can ensure precise calculations, eliminate errors, and maintain compliance with relevant financial regulations. The accuracy offered by remote accounting services helps businesses avoid costly mistakes. Also, it provides a solid foundation for financial planning, budgeting, and forecasting.

d. Seamless collaboration

Collaboration tools enable seamless communication between businesses and remote accountants. This facilitates the efficient exchange of information, feedback, and clarification, reducing delays and miscommunication.

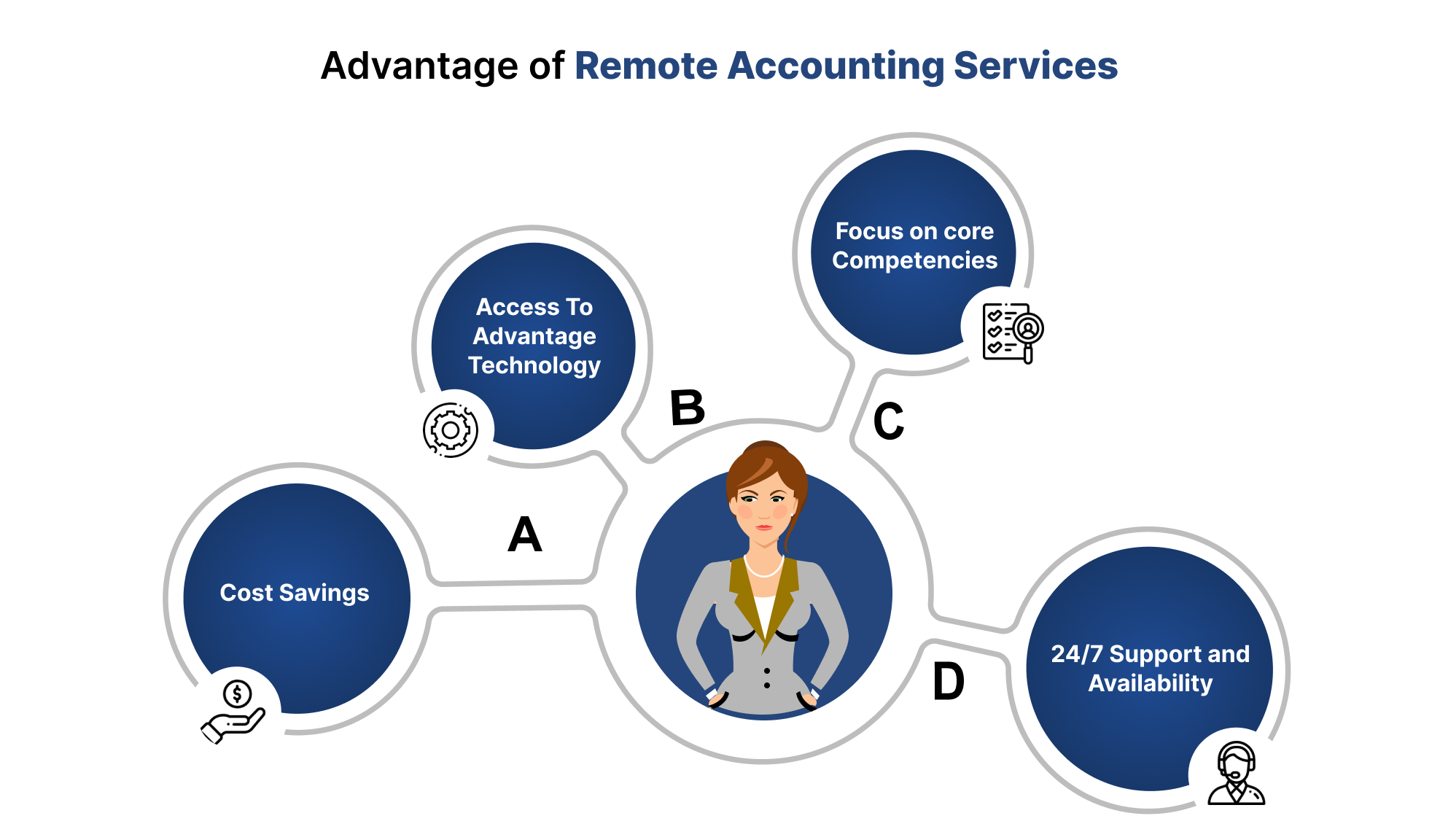

The Advantages of Remote Accounting Services for Your Business

Outsourcing accounting services offer numerous advantages for businesses, revolutionizing financial management in today’s digital era. Here are the key benefits of the adoption of remote accounting:

a. Cost savings

Typically, businesses allocate around 2-5% of their revenue toward the recruitment, training, and staffing of their internal accounting departments. One of the main reasons for choosing remote accounting services is cost savings. Outsourced accounting eliminates the need for on-site staff. This lowers the expenses of staff salaries, perks, space for offices, and equipment. Professional accounting services are available to businesses for a fraction of the expense of retaining an in-house accounting team.

b. Access to advanced technology

Remote accounting services often leverage cutting-edge accounting software and technology that may be costly for businesses to implement on their own. By partnering with remote accountants, businesses gain access to powerful tools and systems without the upfront investment. This enables faster and more accurate data entry, real-time reporting, efficient financial analysis, and better decision-making. Additionally, remote accounting services often provide cloud-based platforms, allowing businesses to securely access their financial information from anywhere at any time, promoting flexibility and convenience.

Must read: Why is Outsourced Accounting and Bookkeeping a Smart Choice for Small Businesses?

c. Focus on core competencies

Outsourced accounting services help businesses focus on their core competencies. It relieves them of the burden of managing their accounting functions internally. By entrusting their accounting tasks to external experts, businesses can redirect their time, energy, and resources toward activities that directly contribute to their core operations and strategic goals. The company offering accounting outsourcing services handles various financial responsibilities. These include bookkeeping, payroll processing, tax compliance, and financial reporting. By offloading these tasks to trained professionals, businesses can ensure accuracy, efficiency, and compliance without diverting their internal resources.

d. 24/7 support and availability

One of the key benefits of remote accounting services is the round-the-clock support and availability they provide. Businesses can rely on constant assistance for their accounting requirements, regardless of the time of day or their geographical location. With remote accounting, businesses can access a team of professionals who are equipped to handle their accounting queries and concerns at any time. Through virtual meetings, video conferencing, and secure messaging systems, businesses can easily connect with their remote accounting team whenever they require assistance or have inquiries. This ensures that urgent issues can be addressed promptly, minimizing potential disruptions to financial operations. The 24/7 support and availability of outsourcing accounting services provide peace of mind and contribute to enhanced operational efficiency and reduced downtime for businesses.

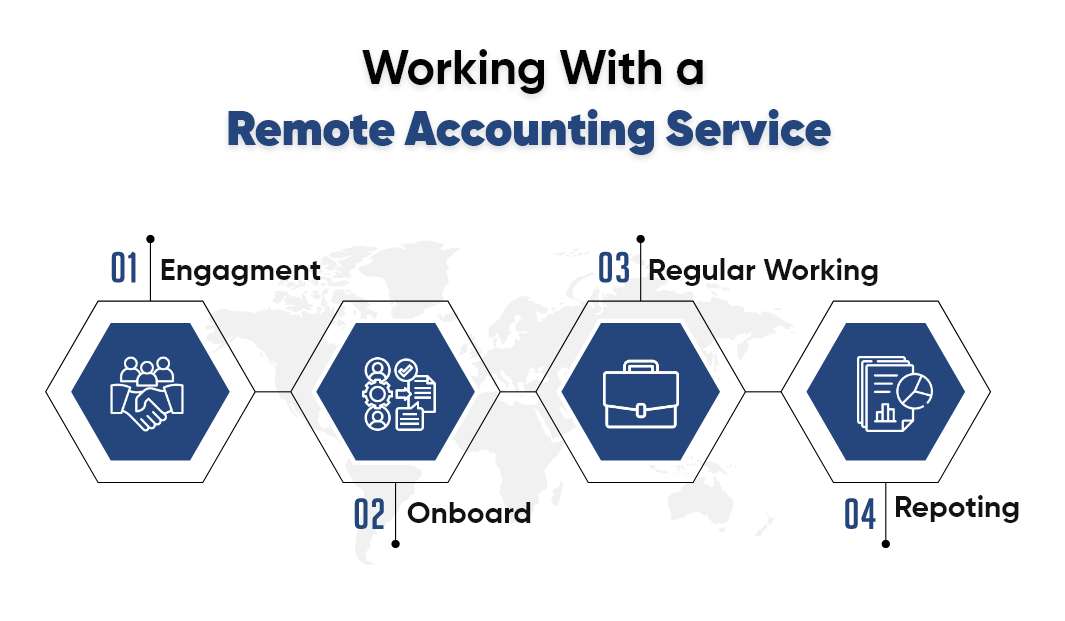

The Process of Working with a Remote Accounting Service Provider

a. Engagement

When a business goes ahead with outsourcing accounting services, the primary step is engagement. This includes researching and choosing a service provider that suits the company’s specific requirements. During the selection process, some of the aspects that should be considered include:

- Having a team of expert and dedicated professionals

- Proven track record

- Reliable data security measures

- On-time services

- Flexible engagement models

- Robust data security measures

Following the selection of a service provider, the next stage involves drafting an agreement. This agreement clearly outlines the outsourced accounting services to be offered, the terms and conditions, along with confidentiality requirements. Both parties should meticulously review the agreement to ensure a mutual understanding of expectations and responsibilities.

b. Onboard

The onboarding process begins after the engagement agreement is signed. Sharing the necessary financial information and documents with the provider of remote accounting services allows the service provider to do their job successfully, the company may need to give access to accounting software, bank account statements, and other financial systems.

Typically, a number of meetings are held throughout the onboarding process. This ensures that the remote accounting team understands the company’s financial operations, reporting requirements, and any unique attributes of the organization. This helps the service provider in gaining a deep knowledge of the company’s financial operations and tailors their services accordingly.

c. Regular working

Following the completion of the onboarding step, the remote accounting service provider begins operating on a regular basis. Recording financial transactions, reconciling accounts, maintaining account statements, and managing accounts payable and receivable are all part of the job. The service provider also ensures that the relevant accounting standards and regulations are followed.

In the normal working process, effective communication is critical. The organization and the remote accounting staff should establish a regular contact plan to discuss ongoing financial affairs, resolve any queries or concerns, and offer financial performance reports. This can be accomplished using messages, video calls, or dedicated collaboration applications.

To ensure quality, the company offering remote accounting services must have clearly defined protocols and workflows in place.

Must read: Small Business Accounting Problems – SOLVED

d. Reporting

Access to timely and accurate financial reporting is one of the primary advantages of remote accounting services. The service provider creates regular financial reports for the organization. These include statements of income, cash flow, balance sheets, and other specific reports.

These reports give insightful data on the business’s financial situation, performance, and trends, allowing for more informed decision-making. The remote accounting staff should make certain that the reports are organized in a clear and comprehensible way, with key metrics highlighted and significant analysis provided.

Periodic review meetings in outsourced accounting services are a part of the reporting process. It involves the remote accounting team delivering the financial reports to the top management of the business. This enables discussions about financial performance, identifying possible areas for improvement, and strategic planning.

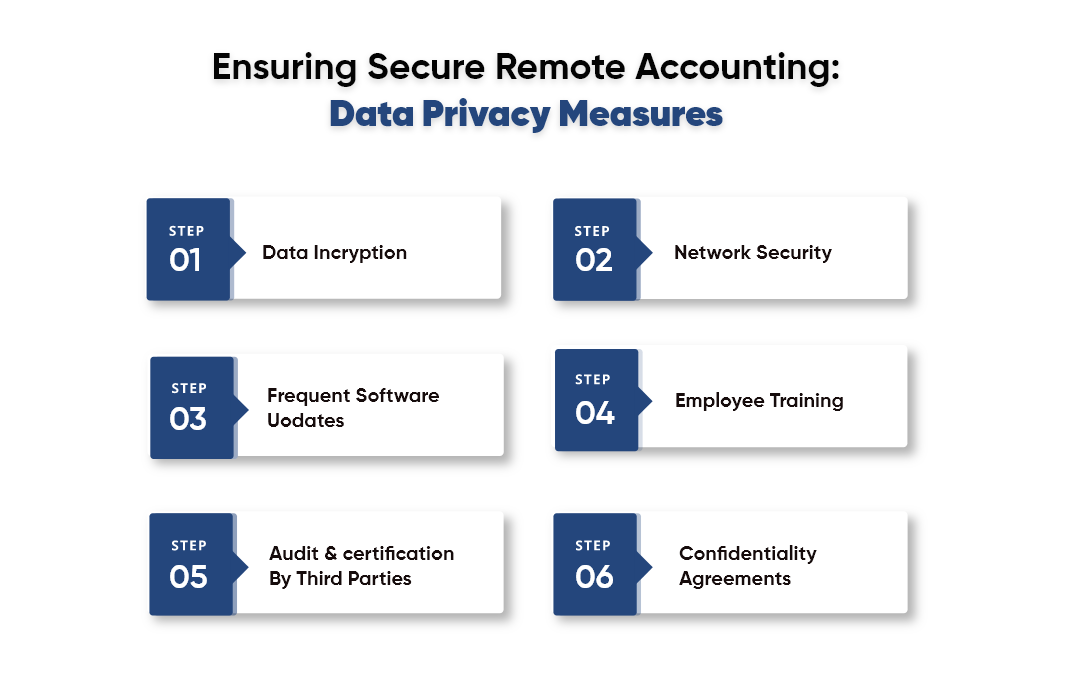

The Security and Data Privacy Measures Implemented by Remote Accounting Service Providers

Data protection is a subject of both ethics and compliance when it comes to remote accounting services. Accounting businesses that fail to fulfill the data security criteria will face ramifications.

According to IT Governance, hackers affected 41.9 million data worldwide in March 2023.

Accounting businesses acquire sensitive information from both consumers and staff members on a regular basis. This data consists of identity card numbers, phone numbers, and addresses, as well as sensitive financial data such as bank account and debit card numbers. These types of sensitive data may draw the attention of cyber criminals.

Data security is the process of preventing unwanted access, corruption, or theft of digital information across its entire lifespan.

The company offering remote accounting services recognizes the significance of security and data privacy when dealing with highly confidential financial data. They usually adopt a variety of security procedures to ensure the safety of customer data.

1. Data encryption

A company offering accounting outsourcing services makes use of strong encryption protocols such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS) to safeguard data in transit and Advanced Encryption Standard (AES) to secure data at rest.

2. Network security

Firewalls, systems to detect and avoid intrusions, and virtual private networks (VPNs) are among the network security methods used by providers. These safety measures assist in preventing unwanted access, network assaults, and data breaches.

3. Frequent software updates

Providers of accounting outsourcing services maintain their software and systems up to date with the most recent security patches and upgrades to guard against vulnerabilities and attacks. This reduces potential security risks and guarantees that any vulnerabilities found are fixed as soon as possible.

4. Employee training

Providers focus on employee awareness and training initiatives to educate their employees about current trends in security and the necessity of data privacy. This includes instructions on how to handle sensitive information, identify phishing actions, and the habit of changing passwords at regular intervals.

5. Audits and certifications by third parties

To demonstrate their dedication to security and data protection, several remote accounting service providers complete third-party audits and earn industry certifications.

6. Confidentiality agreements

In most cases, remote accounting services involve having privacy contracts in place with clients and defining the duties and commitments associated with client data security. These agreements lay the groundwork for ensuring data security and confidentiality.

Must read: Tips to consider while choosing accounting outsourcing company

Finding the right remote accounting service provider for your business needs

Choosing the best provider for remote accounting services according to the needs of your business necessitates meticulous thought and study. Here are some steps which can your search for the best remote accounting service provider easy and convenient:

- Identify your specific accounting requirements

- Conduct comprehensive research

- Ask for reference in your network

- Evaluate the expertise and services being offered

- Consider the technology, systems, and processes being used

- Don’t overlook the communication and support aspect

- Read the reviews from existing clients and ask for references

- Evaluate the pricing structure and engagement model being offered

- Ask for a trial period before getting into a long-term contract

Following these steps will enable you to find and choose an accounting outsourcing services company that best fits your organization’s requirements and ensures the confidentiality and security of your financial data.

Remote accounting services provide various benefits to enterprises looking for effective and safe management of finances. Businesses may expedite their accounting procedures, enhance precision, and concentrate on core operations by using the proper remote accounting service provider. Outsourcing accounting services means that organizations have the ability to view their financial information at any time and from any location. Furthermore, remote accounting service providers prioritize security and data privacy, putting in place strong safeguards like encryption, secure data centers, and user access limits to safeguard sensitive financial data.

Remote accounting specialists’ experience guarantees that tax legislation, financial reporting standards, and industry-standard procedures are followed. Outsourced accounting services provide seamless communication and real-time accessibility to financial information by integrating technology on the cloud and accounting software.

Remote Accounting Services can be the boon that boosts your revenue. We recommend you hop on a call and get all your questions answered by our business head. Schedule a meeting now.