As the era of paper-filed tax returns is coming to an end, taxpayers and tax professionals have started filing taxes electronically more now than ever. As estimated by the IRS, 92% of the 2022 returns have been e-filed. The total number of taxes filed for the year 2021 is 164,246,000. For Tax Season 23, we can expect more than that.

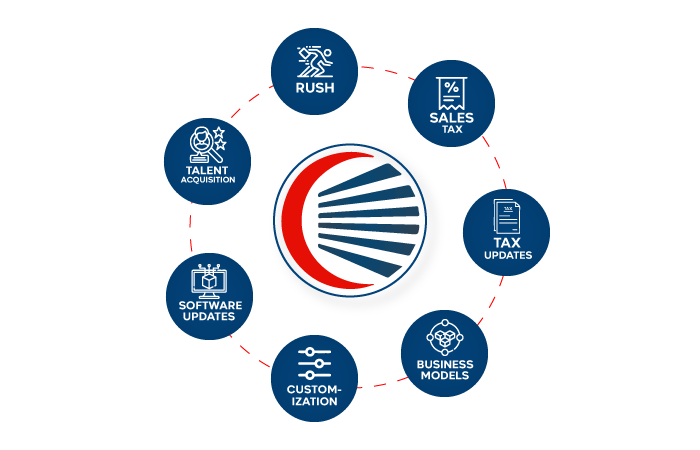

Challenges of the Tax Season

You can never be prepared enough for the Tax Season, considering the challenges and surprises it brings along. Here are a few of the many challenges of the Tax Season.

Dealing with the Rush: Due to the stringent deadlines for tax filing, CPA firms need to prepare and submit tax returns within 2.5 months.

Dealing with Sales Tax: Clients have started shopping across borders even more and the number increases by the second. So, CPAs need to be aware as the Sales Tax Rates differ from state to state.

Dealing with Tax Updates: The IRS recently updated that the Reporting Rules have been changed for Form 1099-K. So, CPAs are required to always be on the lookout for updates. Mistakes can be consequential.

Dealing with new Business Models: Technology has revolutionized the way businesses perform operations. Firms have switched to E-commerce or online modes of operations. This impacts CPA firms as they need to invest in training.

Dealing with Customizations: Every client has different requirements and needs that if not fulfilled, will lead to client loss. So, managing the staff in order to satisfy every client’s requirements gets frustrating.

Dealing with Software Updates: Tax software has constantly been updated every year in order to maximize the efficiency of operations. Certain updates require thorough training.

Dealing with Talent Acquisition: Tax Preparers are professionals with optimum expertise. So, given the competition in this industry, it’s always a challenge to retain them.

Tips to cope with the high volume of tax returns

Here are a few tips which will help you cope with the high volume of tax returns coming your way.

Plan and Strategize

The first step to successfully completing any given task is to plan and strategize it. The battle is either won or lost first on the mind. So, CPAs need to invest time in understanding the scope of work. They need to know the total number of tax returns that they are supposed to file. They need to know the differences in the business models and operations that their clients have.

This also includes knowing the exact number of tax preparers they have so that they are able to allocate tasks and clients accordingly. It’s best to organize the tasks in order of their respective deadlines and how complex they are.

Here’s a basic checklist that CPA firms should keep in mind before you start filling them.

- The total number of tax returns to file.

- The total number of tax preparers they have.

- Prioritize the tax returns based on their complexity.

- If you need more manpower, plan talent acquisition or outsourcing.

Stack up your Arsenal

It’s very common to see CPAs reach out to clients at the eleventh hour asking for crucial documents that were not submitted before. We learn from our mistakes. So, the best way to avoid such last-second mishaps is to make a list of all the deliverables that you will need from the client beforehand. And then let them know about it.

That way you won’t have to worry about missing documents. This is a very important step that you can’t afford to miss before filing taxes. There are multiple ways you can secure all the needed documents from your clients.

- Online Portal (Secured)

- Microsoft Teams (SharePoint)

- Tax Organisers

Also, don’t forget to keep proper track of the documents provided by the clients, by giving proper naming conventions which will help you remember the file locations always.

Also read Tax Tips for 2023 Tax Season: Make Your Tax Process Effortless

Sharpen Your Axe

As mentioned above, the IRS updates its rules every tax season, now the changes may differ on the severity of the impact it has on your operations. But regardless of that, you must make sure that your tax preparers are trained in advance. Your tax preparers can start understanding the updates before the tax season starts.

You can hire Tax Professionals or veterans who have an understanding of tax policies and rules in depth, to train and teach your staff. They will be able to give you a list of best practices as they have seen decades of tax season.

If this is done right, then while preparing taxes your tax preparers will be ready to overcome hurdles caused by the changes and updates in the tax policies.

Tax Software Training

There are many Tax software that have been developed which serve different purposes in tax preparation. Here are a few of them:

- Turbo Tax

- UltraTax

- Drake

- Lacerte

- ProConnect

- ProSeries

- Tax Slayer

- Jackson Hewitt

- H&R Block

- CashApp Taxes

- TaxAct

These software companies have a dedicated team of software developers who are bringing constant changes and updates to the functionalities to better equip the users. If these updates and changes are not practiced, then it can cost you time & money to sit and learn while you should be filing taxes.

Certain software also gives you dummy companies that are meant for practice. The data on such dummies are designed for you to get hands-on practice on all different forms and functionalities.

Keep an Eye till the end

It’s very easy to get carried away with the tax preparation process when the tax return tasks are coming in hot. There is a common tendency to avoid resisting the flow. There are examples of CPAs regretting that. It is very important to monitor the entire process. Because it is possible that the tax reviewer identifies certain critical errors that the preparer could not detect.

If it weren’t for the reviewer, the task would have turned out to be a major failure which could lead to missing deadlines or any other unpleasant consequences. Setting up a proper monitoring system also helps you make sure that the tasks are balanced equally across your team, which prevents an overload of tasks on a particular group of resources.

So, you can set up a proper system where the reviewer will review the tax returns at regular intervals which will maximize the accuracy.

Also read 5 Reasons Why Outsourcing Tax Preparation Will Be the New Normal

Set Up Proper Communication

Every client desire to have proper communication with the CPA firm that is handling their taxes. They are curious and want to know what’s happening every step of the way. They have various questions which demand answers. And you need to be able to satisfy their questions.

In such cases, if you do not have a smooth communication system in place, the clients will not instill trust in you. You can try the below-mentioned mediums which provide smooth video conferencing and calling features.

- Microsoft Teams

- Google Hangouts

- Slack

- Zoom

- Loom

- Skype

Outsource Tax Preparation Services

Many CPA firms outsource tax preparation due to multiple factors that are so grave and crucial to a CPA firm’s growth. CPA firms experience a lack of talent in this industry. Outsourcing comes to the rescue at such times. Tax season brings with it piled-up deadlines, loads of tax returns, and never-ending nights.

But if you opt for tax return preparation outsourcing services, you will be able to focus on increasing the number of clients and welcome more work as there will be a team of expert accountants crunching on the forms, providing you an elite tax preparation support.

The reason why CPA firms are confident with outsourcing is because of the securities and preventions placed. Here are a few of them.

- Your crucial data will never leave your system, as the offshore tax preparer will work virtually, using Remote Desktop Connection.

- You can restrict the system access for the tax preparer, by locking the system IP address, so no other system can access your computer and your files.

- You can implement a least-rights system, which limits the access of the tax preparer to only the clients’ files he’s working with.

- You can monitor the screen activity of the tax preparer using third-party applications.

- Using the latest tools like Authenticators, you can secure your access to the clients’ files.

All Work No Play Makes Jack a Dull Boy

Make sure that you plan and organize events that give your employees a break. Tax Seasons tend to get overwhelming for the staff, as they are overburdened at times. And when things are not working smoothly, they tend to exert their frustration at other things.

So, make sure they take breaks and that they maintain a healthy work-life balance.

Targets must be Realistic

Instruct the team leaders to set realistic targets taking into consideration the actual ability of the staff. If you push your staff unreasonably, they might end up burning out and might even consider jumping jobs. As it is there is cut-throat competition out there along with a labor shortage.

Realistic targets instill confidence in the tax preparers, and they really believe that they can achieve it.

You can also set your team up with To-Do software that helps them keep a track of the pending tasks. Here are a few of them.

- Microsoft To-Do list

- TickTick

- Things

- OmniFocus

- Google Tasks

To Conclude

This blog just sums up a few of the best ways you can cope with the high volume of tax returns coming your way. There might be many more tactics that you personally have discovered and have been implementing successfully. As experts in tax preparation, it is very important for you to prepare a strategy that involves a mixture of best practices that help you maximize your efforts.

Tax Seasons can be very unpleasant if you do not take these things into consideration. America is booming with new businesses. And the pandemic has accelerated that growth manifold. So, the scope of work will increase every year. And that is a good thing as CPA firms are getting more opportunities to prove their worth and increase their goodwill in the market.

Companies are seeking CPAs and Accounting Firms that ensure the accuracy of their tax returns, through which they are eligible for any tax credits or any kind of deductions. Adding to that you might come across certain companies that end up at the eleventh hour with their tax returns, so tax return preparation outsourcing services can be very beneficial to CPA firms, Accounting Firms, and Enrolled Agents as they will be able to handle the oncoming clients with ease and exceptional efficiency.

Experience a Profitable Tax Season by partnering with CapActix, a leading tax return preparation outsourcing service provider.

Why CapActix?

CapActix is a leading offshore staffing company, we have partnered with 150+ clients and have helped them sail through difficult tax seasons. We have come across clients with different business models, which have equipped our accountants with technical expertise that enables them to manage our clients’ tax preparation needs.

If you have not made up your mind yet, don’t worry. You can opt-in for a Free 15 Hour Trial. Post that if you are satisfied with our tax preparers, you can choose if you want to go for an outsourcing model or hiring model.

Our outsourcing model has a fixed rate, whereas our hiring model has 3 different modes. Full-Time, Part-Time, and Flexible Hours.

If you want more information, fix a call with our Business Head and get all your questions answered by scheduling a meeting. Click here to schedule meeting .