CPA Firms are always overburdened during the busy tax season due to a shortage of qualified tax resources. An easy solution gaining widespread popularity is choosing offshore accounting and tax preparation firms to handle tax return preparation services by CPA Firms.

Why Choose Offshore Accounting and Tax Preparation Firms?

Tax return preparation has been a commonly outsourced service, and CPA/Accounting Firms have benefited from low labor costs and quick turnaround times offered by Indian accounting firms. Outsourcing tax return preparation has a wide range of implications, and these firms have had varying degrees of success in outsourcing work for them.

The outsourcing tax return service strategy is increasingly beneficial to accounting organizations, large and small. Accounting firms in the United States and the United Kingdom are overworked. Their obligations grow with each new client they take on. However, a lack of resources results in lower productivity and lower quality work. In such scenarios, outsourcing to Indian accounting firms can have several advantages, particularly for small businesses.

The method of CPA tax preparation is rather straightforward. Offshore accounting and tax preparation firms scan their clients’ tax documents and save them as PDF files on the network. The outsourcing corporations then send the scanned papers to relevant data centers, where outsourcing workers may quickly view them. The tax return is completed and electronically transmitted to a CPA company for review.

How Can it Save Money?

One of the main reasons for outsourcing tax preparation services is to save money on labor. According to the 2006 CPA Journal, while accounting services in the US cost $39 per billable hour, the cost is $15 per billable hour in the case of outsourced tasks.

Another motive is a quick turnaround time. Because of the time difference between the United States or other developed countries and India, a tax return sent overseas during the day is frequently completed on time and downloaded by a global accounting company in the morning.

Merits of Overseas CPA Outsourcing of Tax Return Preparation

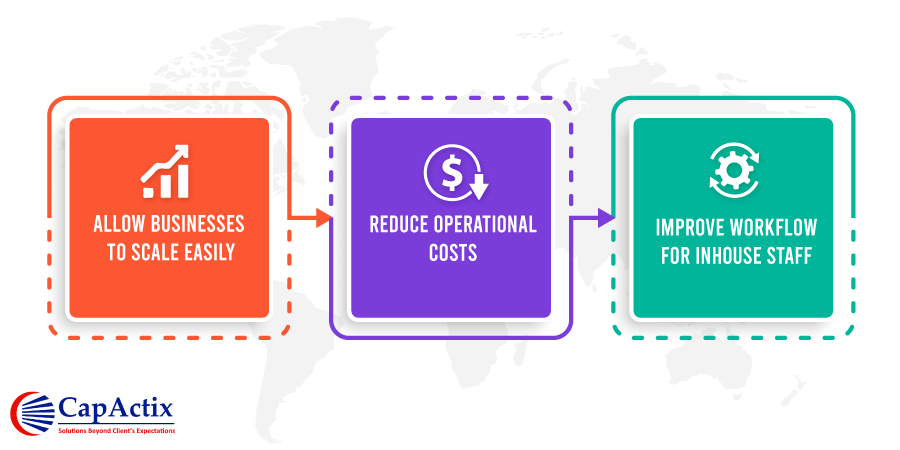

• Allows Businesses to Scale Easily

One of the most important reasons CPA/Accounting firms outsource tax preparation services is to expand their business. Similarly, finding new clients becomes much easier when you outsource these services. You have more time to focus on the clients’ most crucial requirements when you outsource tax preparation instead of being bogged down by financial obligations.

• Reduce Operational Costs

Managing an internal team for these responsibilities could increase the firm’s operational costs. An offshore accounting firm could help cut down these costs. These firms allow you to maximize your return by paying less.

• Timely Services

One of the most important benefits of outsourcing is getting a high-quality job done in your specified time frame.

• Improve Workflow For In-House Staff

Working with an outsourced company to prepare tax returns can help ease the burden on your in-house team of accountants. This helps in the efficiency, workflow, and productivity of your organization.

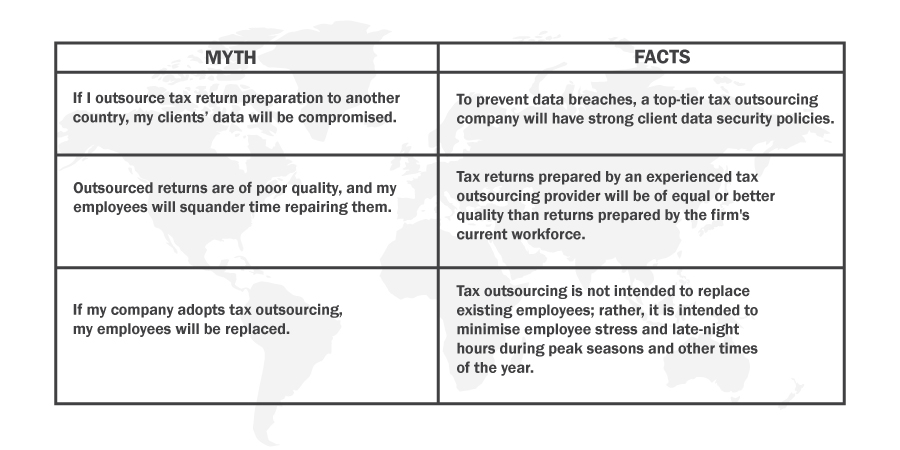

Some Myths and Facts About Tax Outsourcing

Unsurprisingly, most accountants are frustrated because of being overburdened with work, especially during tax season. This often leads to an undesirable position. Similarly, when you as a business are forced to focus on tax preparation tasks, you cannot deliver excellent services to your clients or dedicate enough time and resources for their benefit. Overseas accounting and tax preparation firms are the one-stop solutions to alleviate these struggles and make tax return preparation smooth sailing.

Be aware of the contemporary tax reforms and get proper assistance regarding them. Visit us at Capactix to know more about outsourced tax preparation services and other tax-related regulations. Contact us at +1 201-778-0509 or reach out at biz@capactix.com.