Aid Investment Decisions

Leverage short and long-term financial benefits.

Reduce Expenses

Replace old technologies and equipment with the right planning.

Mounting ROI

Validate a financial plan with reckonable financial propositions.

Served

Perks of CapActix

Why must you invest in the capital budgeting analysis and planning service of CapActix?

Capital budgeting and planning is the fiscal plan of a business created to lead an organization’s operational cost to maximize ROI or make more critical decisions like investing in new equipment, opening a new branch, launching a new product, upgrading a service, etc. to stay profitable. Our tailored capital planning and budgeting services help you effectively manage capital assets by identifying and prioritization of most valuable business assets. We further help you identify major risks to mitigate them effectively and assign realistic and achievable budgets. Our expert capital budgeting analysis service assists in examining your budgeting plan to aid in making the right choices in buying or leasing, technology investment, operational cost savings, and more. A well-defined analysis, planning, and budgeting process and techniques are in our DNA that helps our clients receive remarkable returns.

Services We Excel At

Our Expertise

At CapActix, we assist businesses who don't have resources to do a proper capital budgeting analysis since either management is equipped with routine activities or don’t have in-house capabilities to perform it.

At CapActix, we provide service in typical capital budgeting decisions such as;

- Reducing operational cost by updating technology and older equipment

- Increasing capacity by maintaining new plant, storeroom, or any other storing space for expansion

- Electing the best one from available options to make the best use of money

- Making buying and leasing decisions for property and equipment for growth of business

- Making the best decision on saving operation cost by updating technology

- Any other choice which includes capital investments and their analysis

At CapActix, we provide service in typical capital budgeting decisions such as

- Reducing operational cost by updating technology and older equipment

- Increasing capacity by maintaining new plant, storeroom, or any other storing space for expansion

- Electing the best one from available options to make the best use of money

- Making buying and leasing decisions for property and equipment for growth of business

- Making the best decision on saving operation cost by updating technology

- Any other choice which includes capital investments and their analysis

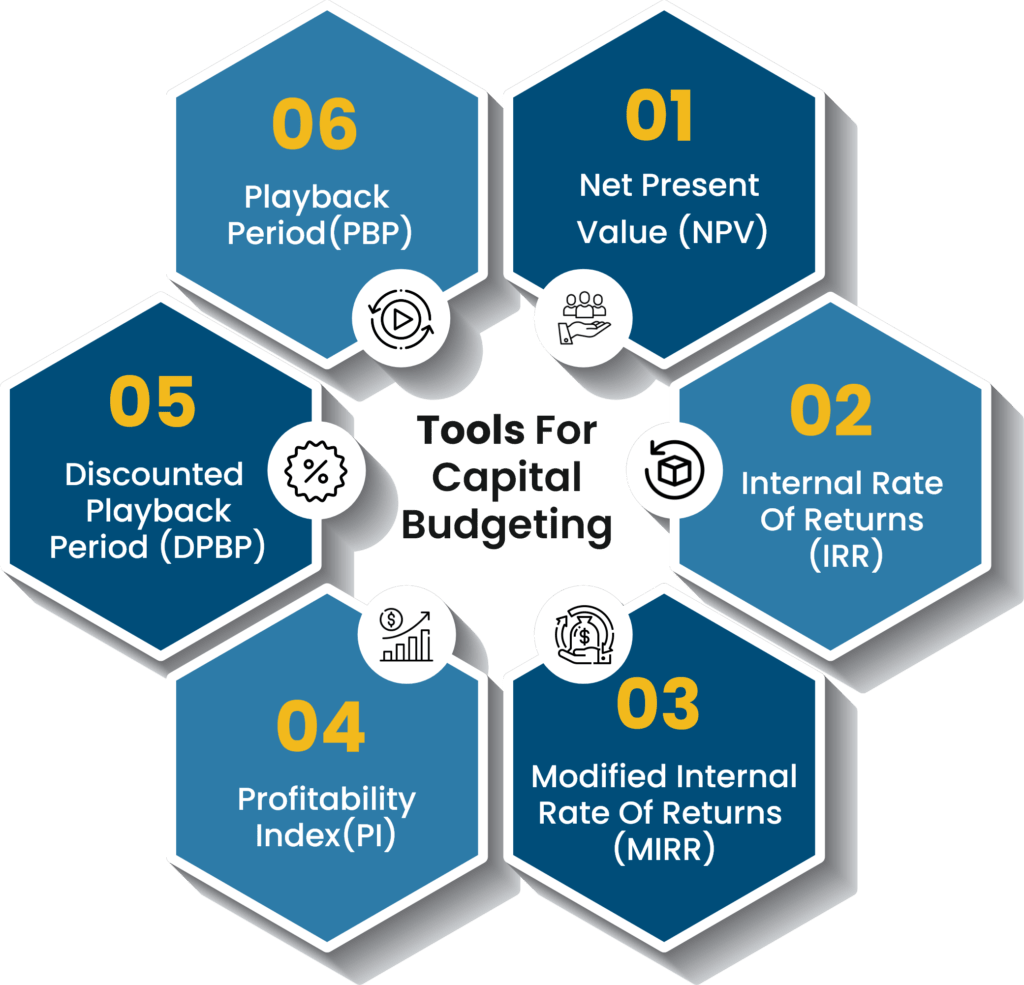

Popular Capital Budgeting Techniques used by our CapActix team are as follows:

- Net Present Value (NPV),

- Internal Rate of Return (IRR),

- Modified Internal Rate of Return (MIRR),

- Profitability Index (PI),

- Payback Period (PBP),

- Discounted Payback Period (DPBP)

Popular Capital Budgeting Techniques used by our CapActix team are as follows:

- Net Present Value (NPV),

- Internal Rate of Return (IRR),

- Modified Internal Rate of Return (MIRR),

- Profitability Index (PI),

- Payback Period (PBP),

- Discounted Payback Period (DPBP)

Hire At Your Convenience

Hire Dedicated Capital Budgeting Experts

Result-oriented Solution

Explore how your business can make smart budgeting and planning possible with our expert assistance:

Wish for expert capital budgeting analysis services for no-regret investments? Call us now to avail the services of our capital budgeting consultants

How We Help You Stand Out

Key Differentiators

01

Detailed Analysis

02

Reliable Tools

03

Complete Assistance

04

Rich Experience

We Create Your Ways Digitally

Software We Use

Our Success Stories

How do our outsourced capital budget planning and analysis services aid the financial decision making of our clients to stay profitable, hear it from some of them:

CapActix helped us save many resources we used to allocate in annual budgeting and capital planning activities with their expert services. They not only understand our needs and goals, but also map out them accurately and represent easy to understand data to make the whole resource intensive job simpler, faster, and more accurate.

We love innovation as it helps us live our vision of staying ahead of the competition by bringing innovation. To invest in the right innovative ideas and product development, an experienced eye for the valuation of the ideas and defining the real profit is necessary. This gap is filled by the team of CapActix. They are outstanding and brilliant in doing this, which boosted our confidence, too.

We use CapActix capital budgeting analysis and other services for a variety of reasons. They help us with assigning priorities to capital requests, estimating project costs, discovering potential revenues, concluding other financial implications, and more in a timely manner. This contributes to making better changes in policies, as well as, budget allocation to keep boosting returns.

Our Focused Industries

Industries We Serve

E-Commerce

Franchise

Agriculture

Healthcare

Manufacturing

Real Estate

E-Commerce

Franchise

Agriculture

Healthcare

Manufacturing

Real Estate