Every business has to deal with accounts since the end game of any establishment is profits. And owing to this fact, Certified Public Accounting Firms (CPA), stay busy and significant around the year. But even to these niche business of accounting, the season for tax preparation and returns can be tiring since they have to deal with a sudden onslaught of multiple businesses competing for their services while also following a strict deadline.

Thus, the CPA firms have come up with the simplest and most straightforward solution for this— outsourcing. In fact, research stands as a testament to the authenticity of this solution. According to research, a CPA firm spends 70% of its resources, be it time, money or people for the purpose of tax preparation. And tax preparation outsourcing can inevitably help the CPA firm save the same.

How can Outsourced Tax Preparation help CPA firms?

1. CPA firms can reduce operational costs by 50%.

In-house tax preparation requires dedicated staff and resources. And even without considering the maintenance cost, it seems to be a huge unnecessary investment. By outsourcing the CPA tax preparation, these firms can save up to 50% of the above mentioned operational costs.

2. Tax Preparation is done by skilled experts.

While the CPA firms have the overall knowledge of finance, certain niche businesses like CapActix Business Solution possess the expertise in CPA tax preparation. Using the services of skilled professionals like auditors and accountants from countries like India, known for their logical minds, CPA firms in the USA and other countries can benefit hugely from outsourcing tax preparations. They are well aware of every aspect of tax preparation and can efficiently work on the client’s tax returns without depending on the CPA’s input or with very little input.

3. Get an edge over your competitors.

While tax preparation and other such services are extremely important for the CPA firms, they eat away the time that can be spent on activities that improve the profits of the business. Simply by outsourcing these services to business experts like CapActix, CPA businesses can utilize the additional time in analyzing the financial market or even their competitors to gain that edge over them.

Read here: 8 Methods to Overcome Tax Glitches While Tax Preparation

4. Get the benefit of time owing to different time zones.

By outsourcing tax preparation services of firms established in the USA to experts in countries like India, where the difference in the time zones being minimum of 10 hours, the CPA firms have an advantage of time. The transactions can be worked on overnight and returned the next morning owing to this time difference.

5. Flexibility of resources

Since you do not require a dedicated staff for working on the tax preparation when you outsource this function, it gives you the pleasure of paying only for those resources that are required. The calculation of taxes that needs to be paid may depend on the profits that the company makes in the year. And by outsourcing this function, the number of resources that are needed to work on the tax preparation align with this and can save the money and time spent on unnecessary additional resources.

6. Better response and customer support.

Firms like CapActix are established solely for the purpose of providing services like tax preparations, accounting outsourcing services, bookkeeping outsourcing services, payroll outsourcing services etc. Thus these companies can provide focused customer support and immediate response when compared to performing these functions in-house, where resources are swamped with varied work.

7. Get the benefit of the latest infrastructure, technology and policies.

The firms in India outsourced for CPA tax preparation keep up to date with the various tax policies, learn the latest technologies and have the most advanced infrastructure to support these technologies. They achieve these by having frequent seminars and workshops to train their professionals. And CPA firms in countries like the USA who outsource these functions can be benefitted without spending a penny on these huge infrastructures and resources.

8. Follow a standard and understandable procedure for tax preparation.

Experienced outsourcing partners like CapActix standardize the process of tax preparation. This makes the process easy to understand by the firm and creates a sense of trust and authenticity to the service. Thus the CPA firms can rest assured of the money that they are spending on both utilizing these services as well as paying the government in the form of taxes. Another advantage is that the firms can easily go back and refer to this standard process if there are any discrepancies.

How does outsourced tax preparation services save 70% of a CPA firm’s cost exactly?

The CPA firms start their savings from the infrastructure costs they might have to bear if the tax preparation is being done in-house instead of outsourcing. As mentioned in the points above, the resources and infrastructure account to 50% of the overall money that goes into the preparation of taxes. These come under the operational costs of the firm which can be bypassed if outsourced.

According to a magazine survey, small companies spend up to 6.9% of their revenue on infrastructure, tier two companies spend up to 4.1% while top tier large companies spend around 3.2%. The average recommended range to spend on infrastructure for any kind of business falls between 4% to 6% which can be achieved through outsourcing tax preparations in the case of CPA firms.

Must read When Are The Taxes Due In 2023?

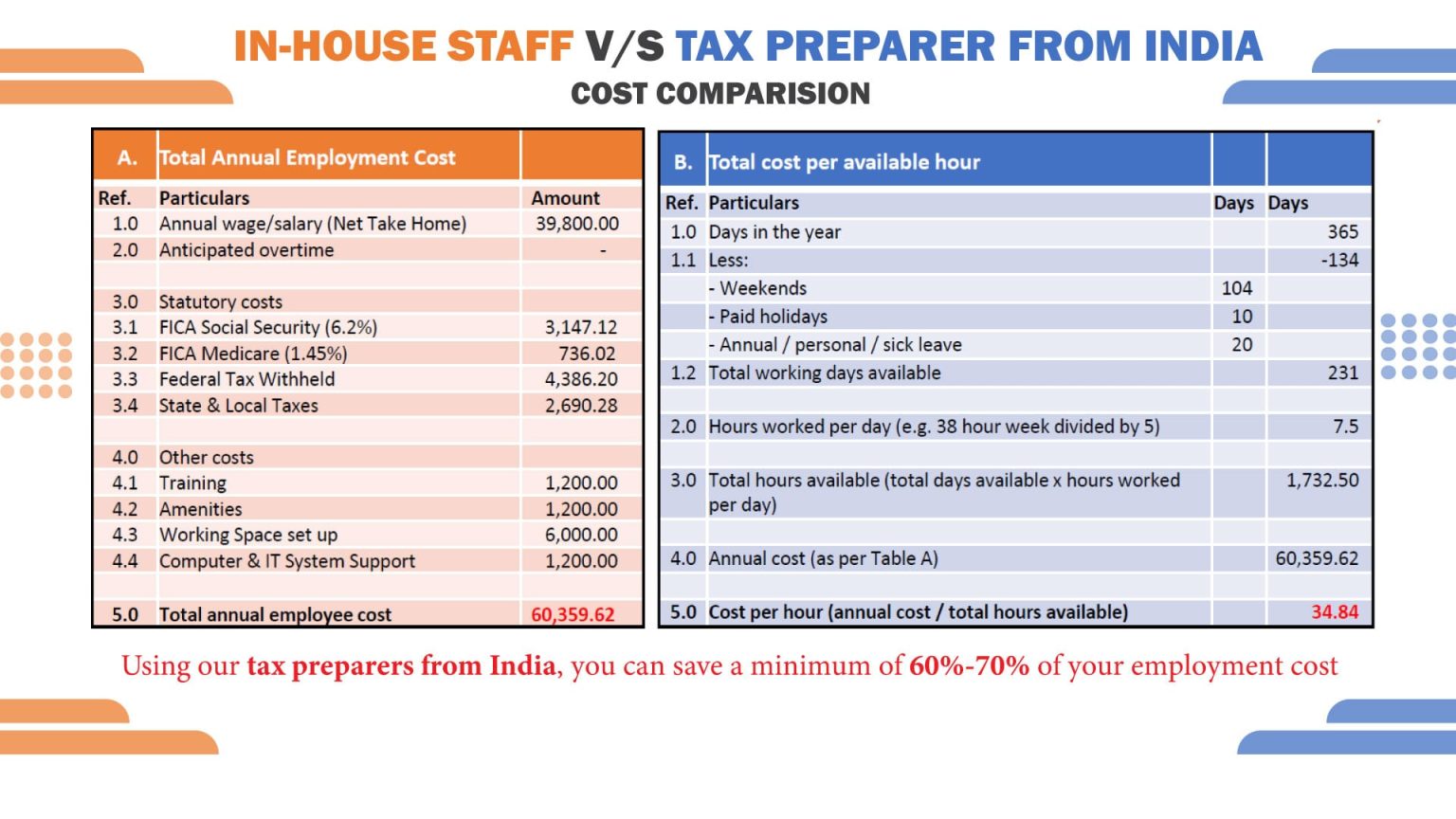

The reduction of cost also comes in the form of the labor wage differential that exists between countries. Considering the USA and India, India acts as a primary source of service suppliers to major CPA companies in the USA. The labor charges hold a substantial difference considering the difference in the value of the US Dollar and Indian rupee.

To get a clear picture, in a CPA firm in the USA, an employee may take $80 USD per hour wherein if the same work is outsourced to India, the labor charges are reduced to $15 USD per hour. Imagine the money saved simply by outsourcing to India.

Apart from the infrastructure costs and labor costs, the CPA firms can have access to the latest software at a reduced price due to the difference in the price tags for the same technology in different countries. For example, in the USA, a company has to pay around $250 to $850 USD while if the task is outsourced, the vendor company is responsible for the procurement of the necessary technology. And in countries like India and China, these technologies cost around $25 USD which is a straight reduction by 90% on the minimum price in the USA. So a CPA firm in the USA can get the same quality of work in tax preparation reduced by an average of 50% due to the price differences on necessary software if outsourced to countries like India.

To summarize the benefits of outsourcing tax preparation services to industry experts, the most focused and vital aspect is the opportunity to save up to 70% costs by outsourcing this function especially to industry experts in India.

All in all, tax preparation outsourcing is a wise choice for all the CPA firms to relegate their resources to work that will invariably bring profits to the firms without neglecting the necessary duties of the financial world like tax returns filing and other services. CPA firms no longer have to worry about handling various aspects of their client’s finances and can simply outsource them to focus on the main critical functions of their own business.

CapActix will provide tax preparation services and save you loads of money in this simple and hassle-free manner. You can acquire our tax services by consulting our team via email at [email protected]. or can call on +201-778-0509.